The Chinese stock market is an important part of the country's economy and has a significant impact on global financial markets. However, it has its own characteristics that distinguish it from Western stock markets such as those in the US and Europe. These differences concern not only the structure of the market, but also the ways of regulation, investor behavior and political influence. Understanding these differences is important for both investors and those who follow the development of the Chinese economy and finance.

In this article, we will look at the key features of the Chinese stock market and compare it with Western markets.

1. Structure and main features of the Chinese stock market

1.1 China's Major Stock Exchanges

The Chinese stock market consists of several major exchanges with which investors are actively working, both domestically and abroad. Major exchanges include:

- The Shanghai Stock Exchange (SSE) is the largest in China, with more than 1.5 thousand companies, mainly large and state-owned.

- The Shenzhen Stock Exchange (SZSE) is China's second-largest exchange, known for a wide list of small and medium-sized companies as well as tech startups.

- The Hong Kong Stock Exchange (HKEX) - is part of China's financial system but operates by international standards. Through this exchange, Chinese companies can raise capital outside mainland China.

1.2 Government Regulation and Influence

One of the most striking differences between the Chinese stock market and the Western ones is tighter government regulation. In China, the government exerts direct and indirect influence on financial markets through various bodies such as the China Securities Commission (CSRC) and the People's Bank of China (PBOC).

- Government support: Chinese state-owned companies play an important role in the stock market. Many of China's largest companies, such as PetroChina, ICBC and China Mobile, are state-owned or parastatals, leading to a close link between government economic policy and the stock market.

- Centralized intervention: In the event of economic instability or crisis, the Chinese government may take measures to control the market, including temporary restrictions on trade and support for share prices. For example, in 2015, the Chinese government suspended stock trading on exchanges in response to a sharp drop in quotations.

1.3 Restrictions for Foreign Investors

The Chinese stock market has long been closed to foreign investors. However, every year the country is increasingly opening up its financial markets to external investment.

- Broad access through programs: In recent years, through mechanisms such as Stock Connect, Bond Connect and QFII (Qualified Foreign Institutional Investor), foreign investors have been able to participate in Chinese securities markets, although there are restrictions on quotas and access mechanisms.

2. Differences between the Chinese stock market and the Western

2.1 Political influence

One of the main differences between the Chinese stock market and the Western ones is political interference. While in Western markets such as the United States and the United Kingdom, government policy is limited mainly to legislative and regulatory control, in China, the state actively manages not only the economic but also the financial sphere.

- In China, economic planning plays a larger role. For example, the government may intervene in market processes to achieve its goals of developing certain industries or territories, while in Western countries a market mechanism with less intervention is preferred.

2.2 Risks and Volatility

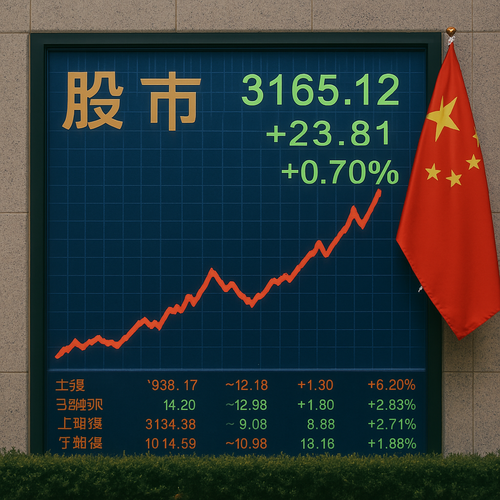

The Chinese stock market as a whole is more volatile and subject to sharp fluctuations. This is due to a number of factors:

- Less mature institutions: Chinese financial markets and institutions are not yet as advanced as in the West, making them less stable.

- Government intervention: There is often a situation where government measures to sustain the market lead to short-term fluctuations, which increases volatility in stock markets.

2.3 Investor Behavior

In China, in comparison with Western markets, there is a large role for retail investors. In many cases, investors in China operate on the basis of emotional or speculative decisions, often succumbing to mass panic or euphoria.

- Western markets, by contrast, are dominated by institutional investors such as pension funds, insurance companies and hedge funds, which have longer-term investment strategies.

2.4 Stock Market Structure and Roles

Chinese markets focus on state-owned enterprise stocks, while Western markets are more dominated by private companies and startups like Facebook, Apple and Tesla.

- China has seen growing interest in tech startups in recent years, especially in the Shenzhen Stock Exchange, which is known for its focus on high-tech companies.

3. Chinese stock market's impact on global economy

3.1 China's Economic Impact

China is the world's second-largest economic player after the United States, and its stock market has a significant impact on global financial markets. A fall in Chinese stocks or a crisis in the Chinese stock market could lead to a drop in global commodity prices, as well as cause a decline in the value of shares in international markets.

3.2 China as a Global Investor

Every year China's role as a major investor in international markets is growing. The Chinese public sector and private companies are actively investing in Western financial markets and emerging economies, which affects global financial flows and stimulates the global economy.

3.3 Impact on Global Commodity Markets

China is the world's largest consumer of many goods, including oil, metals and agricultural products. The volatility in China's stock market could directly affect demand for these goods and, as a result, global commodity prices.

Conclusion

The Chinese stock market has unique features that distinguish it from Western markets. Political interference, high volatility and the dominance of retail investors create a specific atmosphere for investment. However, in recent years, China has been actively opening up its financial markets to foreign investors, which contributes to the increased global influence of the Chinese market. With globalization, the Chinese stock market will continue to play an important role in the global economy, and its dynamics will have an impact on international financial and commodity markets.

In this article, we will look at the key features of the Chinese stock market and compare it with Western markets.

1. Structure and main features of the Chinese stock market

1.1 China's Major Stock Exchanges

The Chinese stock market consists of several major exchanges with which investors are actively working, both domestically and abroad. Major exchanges include:

- The Shanghai Stock Exchange (SSE) is the largest in China, with more than 1.5 thousand companies, mainly large and state-owned.

- The Shenzhen Stock Exchange (SZSE) is China's second-largest exchange, known for a wide list of small and medium-sized companies as well as tech startups.

- The Hong Kong Stock Exchange (HKEX) - is part of China's financial system but operates by international standards. Through this exchange, Chinese companies can raise capital outside mainland China.

1.2 Government Regulation and Influence

One of the most striking differences between the Chinese stock market and the Western ones is tighter government regulation. In China, the government exerts direct and indirect influence on financial markets through various bodies such as the China Securities Commission (CSRC) and the People's Bank of China (PBOC).

- Government support: Chinese state-owned companies play an important role in the stock market. Many of China's largest companies, such as PetroChina, ICBC and China Mobile, are state-owned or parastatals, leading to a close link between government economic policy and the stock market.

- Centralized intervention: In the event of economic instability or crisis, the Chinese government may take measures to control the market, including temporary restrictions on trade and support for share prices. For example, in 2015, the Chinese government suspended stock trading on exchanges in response to a sharp drop in quotations.

1.3 Restrictions for Foreign Investors

The Chinese stock market has long been closed to foreign investors. However, every year the country is increasingly opening up its financial markets to external investment.

- Broad access through programs: In recent years, through mechanisms such as Stock Connect, Bond Connect and QFII (Qualified Foreign Institutional Investor), foreign investors have been able to participate in Chinese securities markets, although there are restrictions on quotas and access mechanisms.

2. Differences between the Chinese stock market and the Western

2.1 Political influence

One of the main differences between the Chinese stock market and the Western ones is political interference. While in Western markets such as the United States and the United Kingdom, government policy is limited mainly to legislative and regulatory control, in China, the state actively manages not only the economic but also the financial sphere.

- In China, economic planning plays a larger role. For example, the government may intervene in market processes to achieve its goals of developing certain industries or territories, while in Western countries a market mechanism with less intervention is preferred.

2.2 Risks and Volatility

The Chinese stock market as a whole is more volatile and subject to sharp fluctuations. This is due to a number of factors:

- Less mature institutions: Chinese financial markets and institutions are not yet as advanced as in the West, making them less stable.

- Government intervention: There is often a situation where government measures to sustain the market lead to short-term fluctuations, which increases volatility in stock markets.

2.3 Investor Behavior

In China, in comparison with Western markets, there is a large role for retail investors. In many cases, investors in China operate on the basis of emotional or speculative decisions, often succumbing to mass panic or euphoria.

- Western markets, by contrast, are dominated by institutional investors such as pension funds, insurance companies and hedge funds, which have longer-term investment strategies.

2.4 Stock Market Structure and Roles

Chinese markets focus on state-owned enterprise stocks, while Western markets are more dominated by private companies and startups like Facebook, Apple and Tesla.

- China has seen growing interest in tech startups in recent years, especially in the Shenzhen Stock Exchange, which is known for its focus on high-tech companies.

3. Chinese stock market's impact on global economy

3.1 China's Economic Impact

China is the world's second-largest economic player after the United States, and its stock market has a significant impact on global financial markets. A fall in Chinese stocks or a crisis in the Chinese stock market could lead to a drop in global commodity prices, as well as cause a decline in the value of shares in international markets.

3.2 China as a Global Investor

Every year China's role as a major investor in international markets is growing. The Chinese public sector and private companies are actively investing in Western financial markets and emerging economies, which affects global financial flows and stimulates the global economy.

3.3 Impact on Global Commodity Markets

China is the world's largest consumer of many goods, including oil, metals and agricultural products. The volatility in China's stock market could directly affect demand for these goods and, as a result, global commodity prices.

Conclusion

The Chinese stock market has unique features that distinguish it from Western markets. Political interference, high volatility and the dominance of retail investors create a specific atmosphere for investment. However, in recent years, China has been actively opening up its financial markets to foreign investors, which contributes to the increased global influence of the Chinese market. With globalization, the Chinese stock market will continue to play an important role in the global economy, and its dynamics will have an impact on international financial and commodity markets.