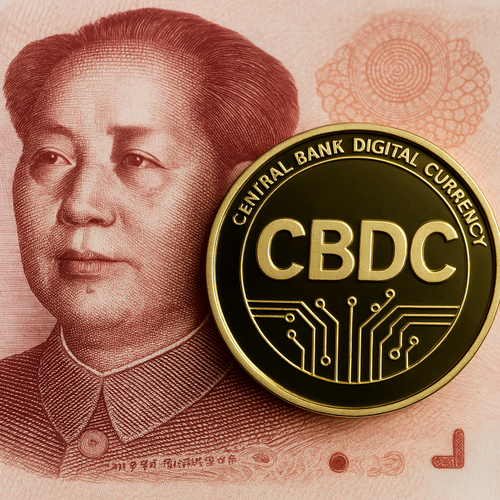

Why China promotes CBDC but bans stablecoins

China, as one of the world's leading economies, occupies a unique position in the world of cryptocurrencies and digital currencies. While the Central Bank of China (PBOC) is actively working to develop and implement its own digital currency (CBDC) - the digital yuan, the country's government has cracked down on stablecoins such as Tether (USDT) and others. The approach raises questions, with many questioning why China, on the one hand, supports the central bank's digital currencies and, on the other, bans private digital assets such as stablecoins.

In this article, we look at why China promotes CBDC but restricts the use of stablecoins, and how this affects the country's financial system.

1. What is CBDC and why does China support them?

CBDC (Central Bank Digital Currency) is a digital form of national currency that is initially controlled by the country's central bank. In the case of China, we are talking about a digital yuan (e-CNY), which is created and controlled by the Central Bank of China (PBOC).

Unlike cryptocurrencies such as bitcoin and ethereum, which are decentralized and have no controlling body, CBDC is a centralised currency fully controlled by the state. This allows governments and central banks to ensure full control over cash flows and manage the economy effectively.

The main reasons why China is actively promoting the digital yuan are as follows:

- Economic control: The digital yuan allows the Chinese government to have full control over cash flows in the economy, improve money supply management and increase transparency in financial transactions.

- Faster payment systems: CBDC enables fast, cheap and secure transactions, both domestically and internationally.

- Combating illegal transactions: The use of the digital yuan allows the government to track all transactions, reducing the risks associated with money laundering and terrorist financing.

- Global influence: China seeks to strengthen the role of its currency in the international arena, and the introduction of the digital yuan could be an important step towards expanding the use of the yuan in global settlements and trade.

Thus, the promotion of CBDC is in line with China's interests to strengthen economic control and support the digital economy.

2. What are stablecoins and why is China banning them?

Stablecoins are cryptocurrencies tied to the value of a stable asset, typically a national currency, such as the US dollar. The most famous stablecoin is Tether (USDT), which aims to keep a stable value of $1. Stablecoins are commonly used to ensure stability in the cryptocurrency world, as they are protected from the volatility that is common in most cryptocurrencies, such as bitcoin.

However, China has taken a tough stance against stablecoins for several reasons:

2.1 Threat to financial stability

The main reason for banning stablecoins is the Chinese government's fear that the use of private stablecoins could threaten financial stability. Unlike the central bank's (CBDC) digital currencies, which are controlled by the central bank, stablecoins are controlled by private companies, posing risks to regulating the money supply and the potential to bypass cash flow controls.

Stablecoins can be used for money laundering, tax evasion and other illegal transactions. This poses a threat to the financial system as private companies that run stablecoins can be at risk of disruption or course manipulation.

2.2 Violation of currency sovereignty

It is very important for China to control the national currency and its use in the global arena. Private stablecoins such as Tether and others, which can be used to exchange and store assets, in parallel with the yuan, pose a threat to the sovereignty of the Chinese currency. If citizens and companies start using stablecoins in large volumes, it could weaken the impact of the Central Bank of China on the economy.

2.3 Competition with Digital Yuan (e-CNY)

Promoting stablecoins could influence the adoption of the digital yuan. The Chinese digital yuan is a state currency controlled by the Central Bank of China and has at its core all the advantages of financial control and regulation. Stablecoins, on the other hand, are private initiatives that could disrupt plans to fully control and integrate the digital yuan into the economy.

3. Digital yuan vs. stablecoins: a strategic difference

The main difference between the digital yuan and stablecoins is the level of control. The digital yuan is a government-controlled digital currency, while stablecoins are private digital assets controlled by financial corporations. The Chinese authorities want to ensure full control over the economy, and the implementation of e-CNY allows them to maintain this control, while stablecoins pose a risk to government regulation.

4. Conclusion

China is actively promoting the digital yuan (e-CNY), as it allows the government to control the financial system, ensure the stability of the currency and strengthen its international role. While stablecoins remain banned, as they pose a threat to financial stability, currency sovereignty and can compete with the digital yuan.

Thus, China's position on digital currencies and stablecoins is driven by a desire to maintain control over financial flows and maintain the yuan's global influence, which underscores the importance of CBDC as a tool in building a digital economy and regulating the money supply.

China, as one of the world's leading economies, occupies a unique position in the world of cryptocurrencies and digital currencies. While the Central Bank of China (PBOC) is actively working to develop and implement its own digital currency (CBDC) - the digital yuan, the country's government has cracked down on stablecoins such as Tether (USDT) and others. The approach raises questions, with many questioning why China, on the one hand, supports the central bank's digital currencies and, on the other, bans private digital assets such as stablecoins.

In this article, we look at why China promotes CBDC but restricts the use of stablecoins, and how this affects the country's financial system.

1. What is CBDC and why does China support them?

CBDC (Central Bank Digital Currency) is a digital form of national currency that is initially controlled by the country's central bank. In the case of China, we are talking about a digital yuan (e-CNY), which is created and controlled by the Central Bank of China (PBOC).

Unlike cryptocurrencies such as bitcoin and ethereum, which are decentralized and have no controlling body, CBDC is a centralised currency fully controlled by the state. This allows governments and central banks to ensure full control over cash flows and manage the economy effectively.

The main reasons why China is actively promoting the digital yuan are as follows:

- Economic control: The digital yuan allows the Chinese government to have full control over cash flows in the economy, improve money supply management and increase transparency in financial transactions.

- Faster payment systems: CBDC enables fast, cheap and secure transactions, both domestically and internationally.

- Combating illegal transactions: The use of the digital yuan allows the government to track all transactions, reducing the risks associated with money laundering and terrorist financing.

- Global influence: China seeks to strengthen the role of its currency in the international arena, and the introduction of the digital yuan could be an important step towards expanding the use of the yuan in global settlements and trade.

Thus, the promotion of CBDC is in line with China's interests to strengthen economic control and support the digital economy.

2. What are stablecoins and why is China banning them?

Stablecoins are cryptocurrencies tied to the value of a stable asset, typically a national currency, such as the US dollar. The most famous stablecoin is Tether (USDT), which aims to keep a stable value of $1. Stablecoins are commonly used to ensure stability in the cryptocurrency world, as they are protected from the volatility that is common in most cryptocurrencies, such as bitcoin.

However, China has taken a tough stance against stablecoins for several reasons:

2.1 Threat to financial stability

The main reason for banning stablecoins is the Chinese government's fear that the use of private stablecoins could threaten financial stability. Unlike the central bank's (CBDC) digital currencies, which are controlled by the central bank, stablecoins are controlled by private companies, posing risks to regulating the money supply and the potential to bypass cash flow controls.

Stablecoins can be used for money laundering, tax evasion and other illegal transactions. This poses a threat to the financial system as private companies that run stablecoins can be at risk of disruption or course manipulation.

2.2 Violation of currency sovereignty

It is very important for China to control the national currency and its use in the global arena. Private stablecoins such as Tether and others, which can be used to exchange and store assets, in parallel with the yuan, pose a threat to the sovereignty of the Chinese currency. If citizens and companies start using stablecoins in large volumes, it could weaken the impact of the Central Bank of China on the economy.

2.3 Competition with Digital Yuan (e-CNY)

Promoting stablecoins could influence the adoption of the digital yuan. The Chinese digital yuan is a state currency controlled by the Central Bank of China and has at its core all the advantages of financial control and regulation. Stablecoins, on the other hand, are private initiatives that could disrupt plans to fully control and integrate the digital yuan into the economy.

3. Digital yuan vs. stablecoins: a strategic difference

The main difference between the digital yuan and stablecoins is the level of control. The digital yuan is a government-controlled digital currency, while stablecoins are private digital assets controlled by financial corporations. The Chinese authorities want to ensure full control over the economy, and the implementation of e-CNY allows them to maintain this control, while stablecoins pose a risk to government regulation.

4. Conclusion

China is actively promoting the digital yuan (e-CNY), as it allows the government to control the financial system, ensure the stability of the currency and strengthen its international role. While stablecoins remain banned, as they pose a threat to financial stability, currency sovereignty and can compete with the digital yuan.

Thus, China's position on digital currencies and stablecoins is driven by a desire to maintain control over financial flows and maintain the yuan's global influence, which underscores the importance of CBDC as a tool in building a digital economy and regulating the money supply.